RFM stands for recency, frequency, and monetary. A marketers tool for customer segmentation, and optimizing ads strategy.

It’s based on the Pareto Principle, where a common belief among businesses is that 80% of the sales come from 20% of the customers. Given this, it becomes quintessential for marketers and advertisers to find out how to nurture that 20%.

RFM can be understood as a tool or methodology which helps companies measure and rank such customers based on factors such as demography, psychological needs, social groups, and other buying habits.

Measuring Recency, Frequency and Monetary

Recency – When was the last time the customer made a purchase? Recency can be measured in days, weeks, months, or years depending on the product type.

Say for a juice vendor, the last purchase of its customers could be only yesterday whereas for a travel agency it could be a couple of months before the customer decides to travel again.

Frequency – How often did the customer buy in a given period? This metric shows returning customers. These could also be first-time customers that can be converted into returning customers through follow-ups and personalized offers.

Monetary – How much are they spending? Customers tend to spend more with every returning purchase.

The RFM scale

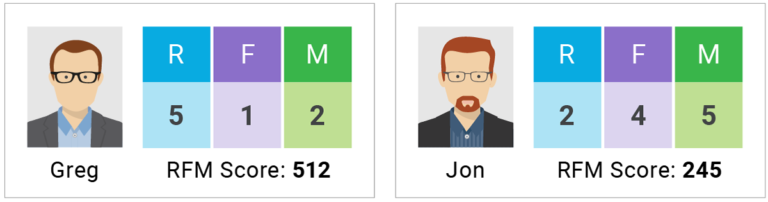

Each attribute is measured from 1 to 5, 1 being the lowest and 5, the highest.

These scores for Recency, Frequency, and Monetary are then combined to get the RFM value, which is a 3 digit score.

The numbers on an RFM scale range from 111 to 555. Let’s look at this example from Cloudkettle –

Greg has a high recency score of 5, but a low frequency and monetary score.

It’s likely that he has just made his first purchase, so they’ll want to enter him into a thoughtfully designed Welcome Journey so that they can make sure he’s getting the most out of his purchase, all of his questions are answered, and he learns a bit more about the brand in the process.

The company can also try to learn more about him during these interactions with progressive profiling in order to determine how we can add more value post-purchase.

Jon, on the other hand, has high frequency and monetary scores, but a low Recency score.

He’s spent a lot of money and bought frequently but it’s been a while since he has made a purchase.

The company may want to take a look at his purchase history and any other known information about him to send him a relevant and valuable offer to get him re-engaged.

Leveraging RFM for Customer Segmentation

The RFM model helps companies segment the customers into Low, Medium, and High-Value categories

Low Value – Low Recency and Low frequency

Customers that bought long ago and have not returned.

Companies would choose to spend cheaper ad campaigns, email marketing alternatives on the acquisition of such customers

Medium Value – Medium Recency and Medium Frequency

Customers that bought not too long ago, and moderately frequently

There’s a tenacity of this customer to convert into a high-value customer. Companies can offer more premium products/services to such customers as a value offering or freemium models to convince these customers to spend more.

High Value – Highest Recency and Highest Frequency

Customers that buy frequently and spend the most

Companies must not lose sight of retaining these customers. Offer this segment early bird passes, exclusive memberships, etc. to retain them

Let me know if you found this article helpful